DSP Mutual Fund 1.0.140

Free Version

Publisher Description

DSP Mutual Fund - Framework-Based, Responsible Investing | Aim to Grow Your Wealth the Right Way

Congratulations- If you’re reading this, you’re already ahead of the curve. While most people download apps to have fun, play games or buy stuff online, you’re making a difference to your future- A great start! Also a good time to remind you of what legendary investor Warren Buffet once said: “Do not save what is left after spending, instead spend what is left after saving.” A little edit from our side- Instead, spend what is left after investing!

So what does our app do?

Simply put, it helps you get going & guides you to stay on course. Here what you can do:

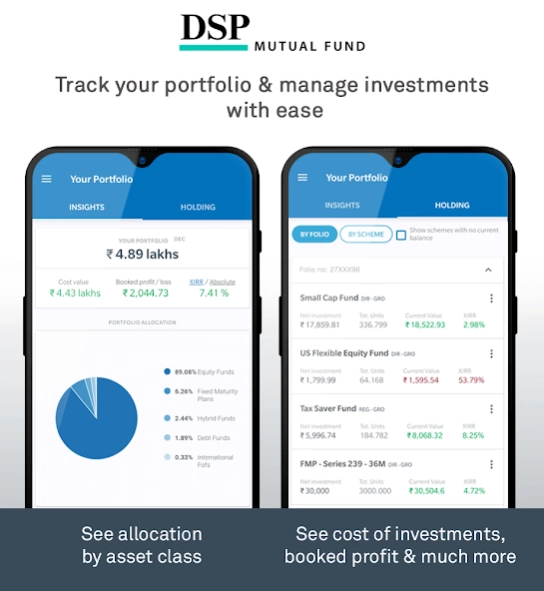

1. Effortlessly track & manage your portfolio: Get a personalized dashboard that tracks all your investments with DSP. View your investment allocation by asset class, cost of investment, returns, profit booked among other things.

2. Create a ‘Family Account’ view: Easily view & track your family members’ portfolios, transactions, systematic plans with DSP. A single view for your entire family- a great way to stay on course for life’s big goals, together.

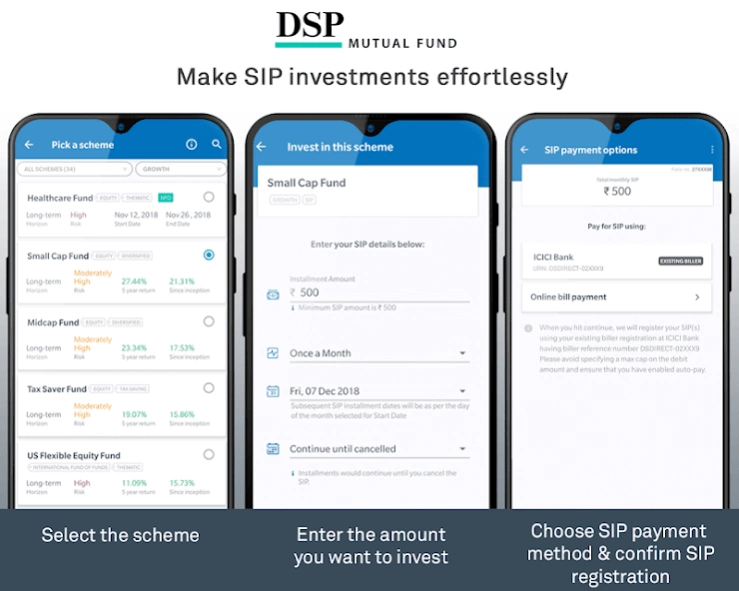

3. Invest conveniently: Make quick one-time (lump sum) investments or start & manage your SIPs (Systematic Investment Plans). What’s more- you can now modify or pause your SIPs easily if you want to. We also allow you to use the payment instruction set for one SIP to start future SIPs fast, on the fly. And yes, you can also start a SWP or STP.

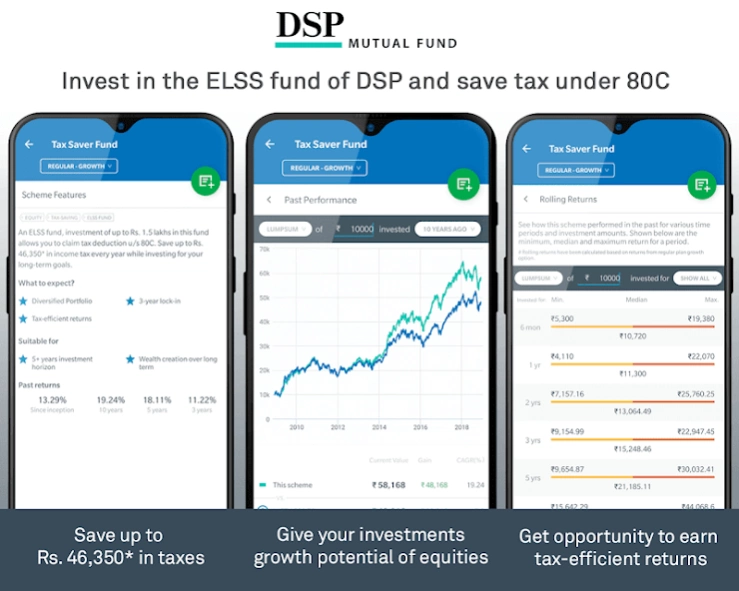

4. Aim to beat inflation & growth wealth: Study & invest in our wide range of equity schemes. Invest in portfolios that let you invest in emerging or small-sized Indian companies, in large or market-leading companies, in some of the biggest international brands & specific sectors in India & abroad, as per your liking. While also becoming fully aware of the risks involved!

5. Save up to Rs 46,800 under Section 80C (of the Indian Income Tax Act, 1961), by investing in our ELSS, DSP Tax Saver Fund.

6. Invest in equity markets but reduce the impact of market fluctuations: Consider our hybrid funds, that let you invest in both equity & debt instruments. Choose from our popular Dynamic Asset Allocation Fund or our two-decade-strong Equity Bond Fund among others.

7. Plan smartly to try to earn better, tax-efficient returns than your idle money, your savings or even FDs: Invest in our rich stable of debt funds & gain from the indexation advantage (when you stay invested for 3 years or more in debt funds, indexation helps reduce the tax you have to pay on profits).

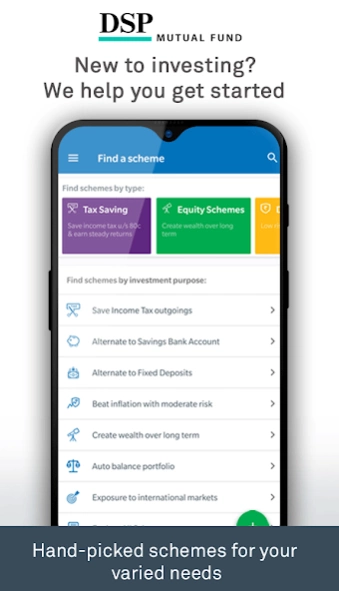

8. Find the right scheme for yourself, via our easy-to-use filters (eg: by time horizon, risk profile, investment goals etc) & detailed scheme pages (with easy-to-study historical performance, risk ratios, latest portfolios, return calculators & more).

9. Withdraw your investments just as easily as you invest: Your money across all our funds is always accessible to you, conveniently (except in our ELSS, where there is a 3-year lock-in period). In fact, our instant redemption facility lets you withdraw your investment in our liquid fund in real time, 24x7. Further, in case there is any exit load applicable, we let you know upfront.

10. Use some of the most popular & convenient methods to invest- Net banking/ UPI/ eNACH (simple, one-time bank mandate for the fastest transactions) among others. You can also register for SIPs just like you would for any utility bill payments!

--------------------------

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. For product labelling & other regulatory disclosures, visit https://bit.ly/2t99jG5 Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. The comparison with FD/savings bank accounts has been given for general information. Unlike FDs, there is no capital protection guarantee or assurance of any return in mutual fund investments.

About DSP Mutual Fund

DSP Mutual Fund is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops DSP Mutual Fund is DSP Mutual Fund. The latest version released by its developer is 1.0.140.

To install DSP Mutual Fund on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2024-03-29 and was downloaded 1 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the DSP Mutual Fund as malware as malware if the download link to com.dsp.invest is broken.

How to install DSP Mutual Fund on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the DSP Mutual Fund is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by DSP Mutual Fund will be shown. Click on Accept to continue the process.

- DSP Mutual Fund will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.